Speaking of which, accountancy software can help you better understand when you need to start thinking about registering for VAT – and help you decide what VAT scheme is best for your business. If you’re still on the fence, let’s take a look at some of the ways accountancy software can make your life easier. How much time you deem sensible to get all your paperwork in shape is up to you. A quick few minutes every day, or a designated time-slot each week is good practice. Failure to sort it out in a timely fashion could result in you paying more tax than necessary, or even worse, being penalised for missing a deadline. Check out our full article on the benefits of opening a business bank account.

FreshBooks is one of the most highly rated and straightforward programs for accurate accounting records, professional bookkeeper services, and more. Keeping track of bookkeeping tasks as a small business owner can be challenging. You have to know the ins and outs of your business expenses and all your personal and business finances. When you think of bookkeeping, you may think it’s all just numbers and spreadsheets. Bookkeeping is the meticulous art of recording all financial transactions a business makes. By doing so, you can set your business up for success and have an accurate view of how it’s performing.

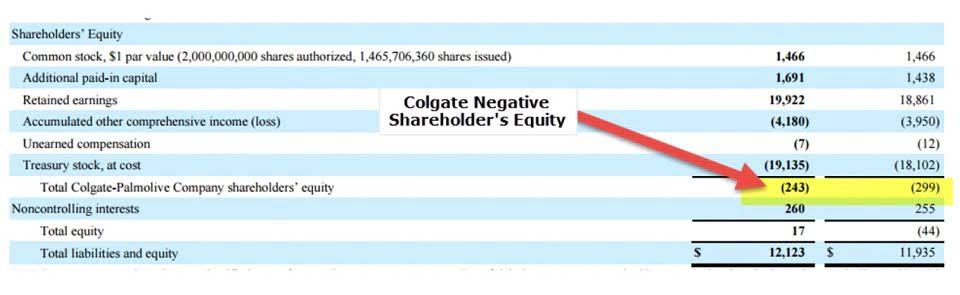

But in larger businesses, third parties may have investments too which you’ll need to take into consideration when calculating equity. Once invoices do get paid, a bookkeeper (or invoice software) will record that payment and swiftly update your records to ensure you’re up to date. It’s critical that you always have a pulse on where your business stands financially at any given time. That’s why a bookkeeper should update your books at the end of every single business day. In this guide, we’ll share everything you need to know about bookkeeping in order to effectively manage your accounts and grow your business.

The same can happen if you don’t categorize your transactions right. Make sure you open a business unearned revenue bank account for your business expenses and do private bank account transactions on personal accounts. Wave provides a cloud-based solution for businesses looking to do their bookkeeping themselves. It’s a great choice if you’d like to manage your finances from anywhere and won’t require additional assistance. Xero is a great option if you deal with any international transactions or have multiple currencies. It offers real-time cloud bookkeeping, and also gives you access to certified accountants.

A great jumping-off point is to choose an accounting software to manage your books and financial data. You can either manage this yourself or hire an accountant to do it for you. It helps you keep tabs on your day to day financial data, monitor your cash flow and evaluate your success. Accountancy software is designed to is bookkeeping easy make the process simpler, after all.

Most accounting software today is based on double-entry accounting, and if you ever hire a bookkeeper or accountant to help you with your books, double-entry is what they’ll use. If you need to borrow money from someone other than friends and family, you’ll need to have your books together. Doing so lets you produce financial statements, which are often a prerequisite for getting a business loan, a line of credit from a bank, or seed investment. Bookkeeping is one of the most important tasks that a business owner will delegate over the life of a business. Without it, it’s nearly impossible to produce an accurate record of financial activities that affect everything, from profit to equity to payroll, and more.

Posting debits and credits to the correct accounts makes reporting more accurate. Take a look at the following four steps to manage your bookkeeping. Effective bookkeeping requires an understanding of the firm’s basic accounts. virtual accountant These accounts and their sub-accounts make up the company’s chart of accounts.